Singapore Quick Response Code is a single QR code that combines multiple e-payment solutions into one. SGQR help to simplify QR e-payments for both consumers and merchants. Singapore Quick Response Code is not a separate payment scheme or payment app. Currently, consumers may see multiple QR codes at merchant stores promoting various e-payment solutions. Consumers would feel confused having to manually find their preferred e-payment option availability. Merchants are impacted by the aesthetic constraints of supporting multiple QR codes on their limited display and retail space. With SGQR, consumers will see a single QR Code label that shows all QR payment options that the merchant accepts. For merchants, Singapore Quick Response Code will be an infrastructure-light and cheaper way to accept multiple types of e-payments

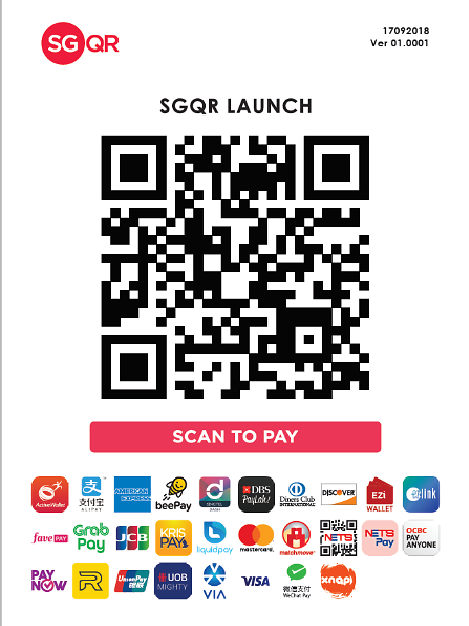

In August 2017, the Payments Council established an industry task force to develop a common QR code specifications for e-payments in Singapore. The Singapore Quick Response Code task force, co-led by the Monetary Authority of Singapore and Infocomm Media Development Authority, consists of members from payment schemes, issuers, acquirers, banks and relevant Government Agencies. The Singapore Quick Response Code specifications are based on the "QR Code Specification for Payment System – Merchant-Presented Mode" issued by EMVCo in July 2017. Singapore Quick Response Code adopts these standards and has customized it for the Singapore market. These include elements and protocols which Singapore deems important for mandatory inclusion – such as the default positions for Singapore-relevant fields, guidance on EMV-specific fields, and the ordering of and code efficiency in merchant account information from payment schemes. Singapore Quick Response Code will be progressively rolled out across Singapore over the next six months. Over 20 leading domestic and international QR schemes in Singapore are part of Singapore Quick Response Code.

Consumers are able to quickly identify their preferred QR payment option is accepted by a merchant. They need only look for the Singapore Quick Response Code label and check if their preferred payment apps are accepted. Simplicity and speed of e-payments were identified by MAS as one of the critical challenges impeding adoption of e-payment options in Singapore. SGQR can be use as a e-wallet where consumers could top up using their credit or debit card, hence consumers retain the flexibility in choosing how to fund their QR payments.

With the consolidation of QR codes, merchant will only need to display a single SGQR label showing the e-payments it accepts, which means less clutter for them and quicker payments by consumers. One single SGQR label are capable of storing both domestic and international QR payment options. SGQR is an infrastructure-light technology, making it a cheaper way to accept various e-payment options. Want to know more about Singapore Quick Response Code? Contact us to learn more.